Options – Definition

Options strategies

————————————————————————————-

Introduction

Derivatives markets or products are named ”Derivatives” because they are “derived” from products negotiated on the spot markets.

Derivatives are products based on an underlying which can be a forward contrat (i.e. Future), an equity, an index, an FX exchange,… negotiated in a spot market.

For instance, currency options are ”derived” from FX spot market e.g. the underlying is an FX spot contract.

Initially, Derivatives were limited to options and Futures contracts.

Nowadays, other products such as IRS, FRAs, Warrants, etc… are included in Derivatives definition, usually including notional amounts and with leverage features.

Options

Option definition

An option is the ability (right) for its owner to buy or to sell an underlying (index contract, FX spot deal, IRS, Equity, Commodities,…). Conditions of duration and prices are pre-determined at the negotiation stage.

In an option deal, you will find a buyer in front of seller. The buyer, by paying a price (called ”premium”) to the seller, takes the option to exercise or not its right.

On the other side, the seller, by will earn the premium but will be dependant from the buyer’s decision to buy or to sell the underlying.

Options characteristics

-

Buying and selling options

There are two kinds of options positions : buying Call or Put options e.g. long options and selling Call or Put options e.g. short options.

Buying a Call, is buying a ”right to buy” an uderlying at a predetermined price within a time frame. Buying a Put is buying a ”right to sell” an uderlying at a predetermined price within a time frame.

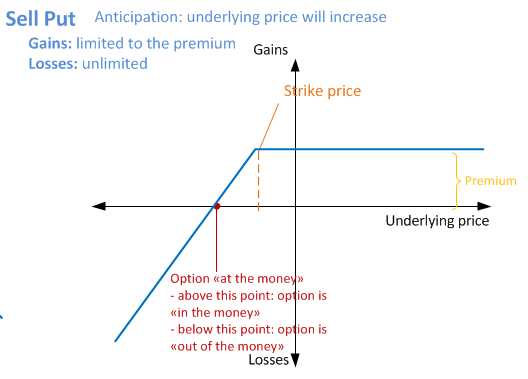

Symetrically, selling a Call consists in, provided the counterparty exercises its right (to buy), selling the underlying in the conditions defined in the contract (quantity, price and date and time frame).

Selling a Put consists in, provided the counterparty exercises its right (to sell), buyig the underlying in the conditions defined in the contract (quantity, price and date and time frame).

Summary

Dealer Position: Buy / Long

- CALL: Right to buy

- PUT: Right to sell

- CALL : Commitment to sell

- PUT : Commitment to buy

-

European Options

An option withn an “European style” implies a specific and unique exercise date. In other terms, such an option can only be exercised at expiration date.

-

American Options

Unlike an “European” option, “American” style options may be exercised during a period of time, and this at any time. Therefore for such a contract, start date and end date of the option are defined. This option can always be exercised until its maturity date.

-

Exercise (strike) price

When the exercise price (strike price) equals the spot price during the transaction, option is ‘at the money’.

If the exercise price is cheaper than the spot price (Strike > spot price for a PUT, respectively < spot price for a CALL), the option will be ‘in the money’. In the opposite case, the option will be called ‘out of the money’.

Targets

An option contract counterparties thus placed in different situations in terms of risk. In effect the buyer is master of its destiny to the extent that it deserves the right to exercise its right or not. Its risk of loss is limited to the premium paid. Conversely, the seller is unlimited risk since it is completely dependent on the evolution of the underlying market. Adverse developments, it can of course control, will inevitably exercise the option by its counterpart, and therefore a loss for him.

These scenarios can be represented with following gain/loss diagrams:

Objectives of the buyer

The buyer of an option anticipates a trend in the underlying in his favor, compared to the price fixed in the option. Thus, if you buy a call, he anticipates a rise in prices which will enable then to buy the underlying at a price below the market price. Similarly, if a put buyer is that it anticipates a decline in turn allows them to sell at a price above the market price. Then he will appreciate its gain relative to the result achieved on the underlying, given the premium paid to the seller.

Objectives of the seller

Of course, the option seller has expectations of changes in the course of the underlying conflict with the buyer. He hoped that the buyer will not exercise his option and he will have earned the option premium.

Options Strategies

Strategies on volatility

- The straddle

A straddle is the simultaneous purchase of call and put at same strike price, the same maturity and same nominal. Exchange for a straddle, the exercise price is equal commonly chosen in the forward exchange. We speak of ATMF (at the money forward). The buyer of a straddle anticipates a significant price change, without knowing the direction (upward or downward). This variation should be large enough to cover the payment of two premiums, and if possible the exercise of one of two options.

Gain / loss diagram for a purchase of Straddle:

Gain / loss diagram for a sell of Straddle:

- The strangle

The strangle is also consistent with the simultaneous buying of a call and a put with the same maturity and same nominal but different strike prices. In addition, these prices out of the money will minimize the amount of premiums paid. The volatility spread should be larger to allow the return of premium.

The buyer expects to strangle a highly volatile market, regardless of the direction of this one.

Conversely the seller hopes to strangle a drop in volatility to remain in the gain range.

Gain / loss diagram for a purchase of Strangle:

Gain / loss diagram for a sell of Strangle:

- The Butterfly

The butterfly (butterfly) is buying a strangle and straddle the simultaneous sale of the same maturity and same nominal (or vice versa). The buyer of a butterfly hope some price stability while the seller believes to major movements.

- The Condor

The condor is a strangle purchase and simultaneous sale of another well strangle échéancee and same nominal but different strike prices (for a condor exchange, will strangle the exercise price closest to the futures price than the strangle).

The buyer of a condor believes in some price stability.

- The Seagull

The seagull (Herring) is buying a call (or put) spread and the simultaneous sale of a put (or call) with the same maturity and same nominal (or vice versa). Usually it is arranged that the premium received offsets the premium paid: we talk of zero cost.

The seagull may for example be used to benefit from higher prices of the underlying asset without paying premium.

Strategies on prices

- The call / put spread

The call / put spread is the purchase of an option (call or put) the exercise price Pe1 associated with the sale of an option in the same direction (call or put) the exercise price Pe2. For a call spread, we Pe2> Pe1 and a put spread was Pe2 <Pe1).

Profit is obtained when assessing the underlying with a loss equal to the maximum to the premium paid.

- The Collar

The collar is the purchase of an option (call or put) associated with the sale of an option in the opposite direction (put or call). This type of option is also called synthetic term.

Of course a collar type could purchase + sales call is entirely possible. This type of strategy is insensitive to changes in volatility.

Strip and strap

Strategy to buy more of that call to put (forecast increase – strap) or more could only call (forecast down – strip).